By Adam Bexson, Senior Consultant

When it comes to workplace pensions, the way we talk about them is just as important as the benefits themselves. Too often, pensions are described as “dull” or “boring” – sometimes even by those trying to make them relatable. While this might raise a smile, it risks reinforcing negative perceptions and discouraging engagement.

For employers, this matters. If employees see pensions as complex and unappealing, they’re less likely to take action. So, how can we change the conversation and inspire engagement?

Let’s explore why language matters and practical ways you can make pensions feel simple, exciting, and worth paying attention to.

Why language matters in pension engagement

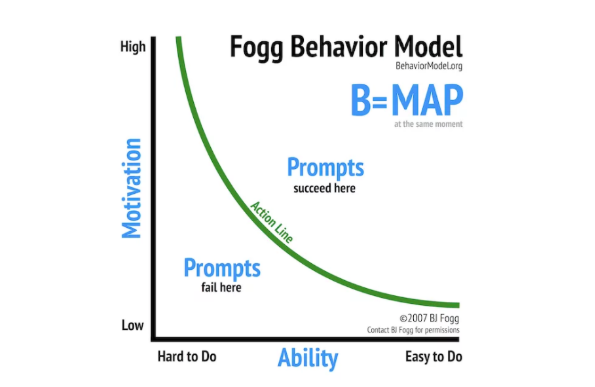

According to the Fogg Behaviour Model, action depends on two things: motivation and ability.

If pensions feel intimidating or irrelevant, employees will delay decisions—or ignore them altogether. Framing pensions as boring creates a barrier that HR teams can help remove.

Instead of apologising for the topic, highlight its benefits and simplicity. Every conversation about pensions is an opportunity to build confidence and show employees how these savings can transform their future.

Boost motivation: Make pensions feel attainable and exciting

Frame goals as achievable

Large target figures—often hundreds of thousands of pounds—can feel overwhelming, especially early in a career. Instead, focus on the journey.

Show how small contributions today grow over time through compound interest. Use examples that make the concept tangible and reassuring.

Make it easy and exciting

People love the idea of money working for them. Why not use language that taps into this and position pensions as a form of passive income?

“Your workplace pension can be the easiest way to get your money to grow.”

Joining is effortless through auto-enrolment, increasing contributions is simple, and the long-term growth happens without extra effort. This reframes pensions as something exciting rather than a chore.

Reduce perceived complexity: Keep it simple and relatable

Pensions are like car engines or smartphones: complex inside, but easy to use. Employees don’t need to understand every detail to benefit. Use analogies, clear language, and visual aids to show growth over time.

Layered information works best

People vary in how much detail they want. While some prefer a simple overview, others may need deeper insights.

Offer a quick-start guide and detailed resources for those who want more—just like how consumer electronics offer a quick-start guide alongside a full manual. This approach meets different needs without overwhelming anyone.

For example, a simple overview can explain auto-enrolment and contribution options, while deeper content can cover how pensions positively affect their tax position or share information about investment choices.

Practical communication tips for HR teams

- Avoid apologetic language (“sorry, this is boring”). Instead, highlight benefits and simplicity.

- Use clear, concise language and visuals to show how contributions grow over time.

- Incorporate social proof: share relatable examples of employees benefiting from pensions.

- Make it easy to take action: include links to increase contributions or access resources.

How much detail do employees need to engage?

Most need only the essentials and one clear action. Provide deeper content for those who want it via layered pages and signposts.Is a small contribution increase really worth it?

Yes. Even a 1% increase, sustained over time, can have a meaningful impact thanks to compound growth and potential employer matching.

Why this matters

Since the introduction of pensions freedom and flexibility in 2015, the way we communicate pension targets has changed. This is because more people are now expected to access their pensions in a flexible way. As a result, we often see target funds in the hundreds of thousands of pounds – and for those early in their careers, this can feel out of reach.

The key is understanding compound growth and future earnings. Small contributions made today can grow significantly over time, turning what seems impossible into something achievable.

Ways to address this challenge

This challenge is all about framing and context.

One approach could be to start by showing the impact of inflation on future earnings and how compound growth works on even a small amount invested. Then, once that’s clear, introduce the size of the fund needed.

This helps people see the journey rather than just the destination.

Ready to change the conversation? Let’s make pensions engaging together

The way we talk about pensions can transform how employees feel about their financial future. By making pensions feel simple, exciting, and achievable, you can boost engagement and help your workforce take meaningful action.

The way we talk about pensions matters. By changing the narrative, you can turn a perceived chore into a compelling benefit.

If you’d like expert support to improve your pension arrangements and engagement, get in touch. Our consultants can help you create strategies that resonate and deliver results.