By Sharon Harwood-Davis, Kelly Parsons, Craig Williams, and Emily Jones

Our latest survey asked employers what they expect to be their biggest employee benefits challenge in 2026. The responses reveal not just one challenge but a cluster of issues that will shape strategies for the next few years ahead.

This article shares a practical, data-led view of those challenges: what they mean, how they connect, and how employers can respond with confidence.

Cost pressure is real, but it’s only part of the story

The findings underline a truth we see every day: cost is the headline, but engagement and competitiveness are the slow-burn risks that can erode value of employee benefits if left unchecked.

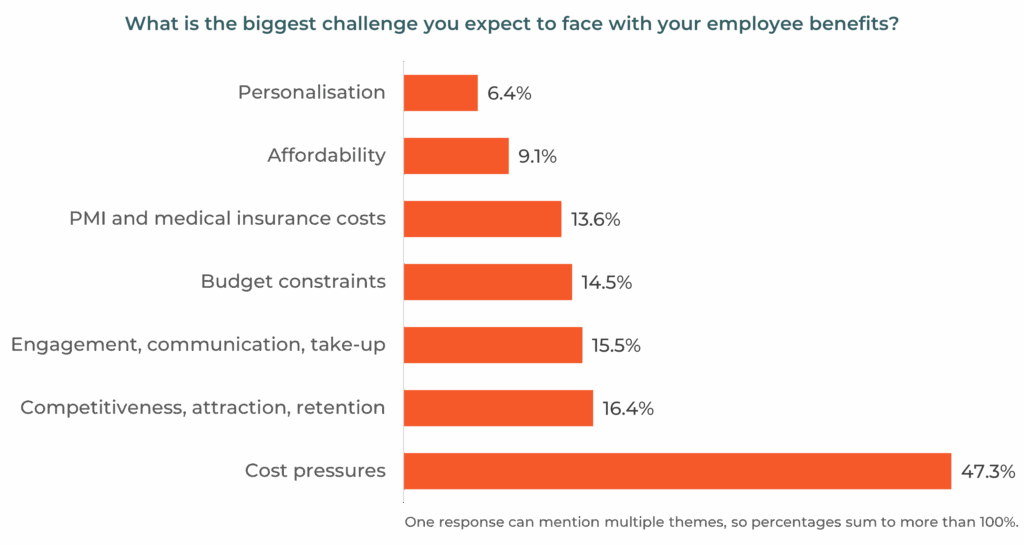

- Costs and budget constraints: Almost half of organisations (47.3%) said cost pressure is their number one employee benefits challenge.

- Medical and PMI costs: 13.6% flagged the cost of employee health and private medical insurance (PMI) as a specific concern.

- Engagement, communication and benefits take-up: 15.5% admitted they struggle to get employees to notice and use their benefits.

- Competitiveness for attraction and retention: 16.4% worry about keeping their employee benefits package relevant and attractive in a competitive market.

Other issues such as changes to legislation, National Insurance and National Minimum Wage (4.5%), personalisation of benefits (6.4%), and affordability for both employers and employees (9.1%) appear in smaller numbers but still matter for long-term strategy.

Two subtle but important takeaways flow from this.

First, cost control without purpose can undercut engagement and value, especially when employees struggle to access timely healthcare or navigate choices.

Second, engagement and competitiveness are slowburn risks: less visible than budget lines, but corrosive if employees don’t notice, understand or value what’s offered.

Both point towards a strategic response rather than cutting benefits alone. One that balances affordability with impact and reflects company demographics and workforce needs to keep personalisation at the centre.

Context that matters

The UK employee benefits landscape report shows how employers are already adapting and where gaps persist. For instance, after the Autumn 2024 Budget, 43% of organisations introduced salary exchange to manage rising employment costs.

Employers are also grappling with sickness absence rates at a 15-year high (Source: CIPD). Those without healthcare benefits rely on an NHS system where employees face delays for GP appointments and specialist care – impacting productivity and increasing indirect costs. This makes an employee benefits strategy not just a financial issue, but a workforce resilience issue.

With NHS services under strain, demand for private healthcare is rising as are premiums. 51% of employers are now offering unlimited outpatient cover, and 26% are considering introducing a health cash plan in the next three years.

This broader context matters and these trends confirm what the challenge analysis suggests: organisations need smarter strategies, not short-term fixes.

What should HR teams do?

The challenges ahead aren’t just about cost. They’re about clarity, engagement and resilience. Here is a practical, step-by-step pathway to help you navigate 2026 and beyond confidently.

1. Audit and align

Start with an employee benefits audit to give you a clear baseline for decision-making. A structured audit replaces anecdote with evidence, surfaces quick wins, and prevents “cut and hope” decisions that erode trust and value.

Areas you should consider:

- Cost and design: Where are the cost drivers? How do your benefits compare with other employers (e.g. employer pension contribution, PMI excess, outpatient cover, group risk deferment terms)?

- Usage and relevance: What benefits are used, by whom, and when? Are there any gaps in your offering that matter to your employees? Are valuable services underpromoted, or others over-utilised? Check for duplication; not only between your employee assistance program (EAP) and insurer provided wellbeing services, but across the broader benefits package.

- Governance and outcomes: Do you track outcomes and value-for-members indicators across all benefits, not just pensions? Is communication simplified and comprehensible for the whole workforce?

Benchmark your benefits

Benefits shape your employee experience, influence retention, and impact wellbeing. The question is: how do you stay ahead?

The Benefits Barometer helps you identify where your offering stacks up – and where it might be falling short.

Whether you’re reviewing your workplace pension, or your employee health and protection benefits, you’ll get a clear, data-led view of your current situation.

2. Redesign rather than remove

In a competitive labour market, employee benefits are a critical lever for attracting and retaining talent. 16.4% of employers highlighted competitiveness as a top concern. And benefits that feel outdated or inflexible, risk undermining your employee value proposition (EVP).

Explore strategies and options that protect value without cutting benefits. Target changes that protect what employees value while controlling renewal and administration costs. For example:

- Salary exchange (also known as salary sacrifice) can deliver National Insurance (NI) savings for both employer and employee – and is still worthwhile even with changes coming in 2029. It’s among the simplest steps for budget relief that preserves value. Read more about the benefits of salary exchange.

- Consider strategic levers, not shortcuts. PMI excesses and outpatient limits can support cost management but it’s best to start with a broader review. Look at wider options such as benefit restructuring, eligibility changes, or blending company-funded and voluntary options (employee paid) to maintain value while controlling spend.

- Focus on prevention. Look beyond stand-alone wellbeing programmes by ensuring benefits work together. Consider programmes that build mental, financial and physical resilience. Create clear claiming pathways for employees and managers and use data from multiple sources to build a deeper view of your organisation’s health. This will support better outcomes, stronger productivity and reduce indirect costs from absence and presenteeism. Read more about what’s shaping workplace wellbeing.

“Salary exchange is a practical win-win. It reduces NI and keeps contributions affordable for both employers and employees. And even with the £2000 NI cap coming in 2029, it remains a meaningful way to support financial wellbeing across pensions and wider benefits.”

Kelly Parsons, Head of DC Proposition

3. Reboot engagement

Even the best benefits fail if employees don’t use them. Since 15.5% of respondents cited engagement, communication and benefits take-up as their biggest challenge, every pound and hour you spend should work harder by improving actual usage, not just awareness.

To increase engagement, try moving away from generic ‘one-size-fits-all’ emails to timely and relevant communications:

- Life-event triggers (new starter, parenthood, moving home, active care episode) to surface relevant benefits at relevant moments.

- Nudges and pathways that reduce choice overload with curated menus rather than exhaustive lists.

- Feedback loops via pulse surveys and 1to1s (the landscape report shows surveys as common practice, but direct feedback remains underused) to refine relevance and messaging.

“The cheapest benefits are the ones your employees actually use.”

Sharon Harwood-Davis, Head of Corporate Healthcare Pricing

4. Embrace technology

With 30% of organisations still managing benefits manually, many are missing out on the engagement and insight that modern platforms can unlock. If you’re still managing benefits manually, now is the time to change.

Benefits technology does more than lighten administration. Its real value is connecting your whole benefits offer. Platforms like Flexcel improve engagement, data flows, governance and personalisation while helping employees navigate their benefits day-to-day, not just at renewal.

From claiming pathways to manager guidance and topic-led hubs (such as mental health or financial wellbeing), technology can bring your benefits together in one place – boosting understanding, take-up and impact.

“Technology isn’t just an efficiency tool. It’s the gateway to flexibility and personalisation.”

Craig Williams, Director Employee Benefits Technology

Why act now?

Cost pressures aren’t going away. But with the right employee benefits strategy, you can control spend, improve engagement, and strengthen your competitive edge – all while protecting employee wellbeing.

The gap between intention and action is widening; cost pressures will persist and manual processes will limit agility. Meanwhile, your employees want choice, clarity and access – especially when NHS pressures affect health routes and when financial stress drives short-term decisions (like pension optouts) that harm long-term financial wellbeing.

Here’s a quick recap of what you can do:

- Build an employee benefits portfolio that works harder: prioritise benefits that directly support your employees’ health access, financial resilience, and retention.

- Use benefits technology to personalise and simplify admin: offer flexibility where it adds real value, guided pathways, and short, timely nudges.

- Make workplace pensions visible and valuable: measure expected outcomes, review investments, and provide targeted financial education so your employees understand the impact of contributions and investment choices.

- Treat employee engagement as a product: design communication as a service making them helpful, timely and human.

“The winners in 2026 will be those who combine cost discipline with creativity. It’s not about cutting benefits; it’s about making them work harder.”

Emily Jones, Head of Workplace Wellbeing

A final thought

Employee benefits are under pressure like never before. Economic uncertainty, healthcare inflation, and shifting workforce expectations are forcing HR and reward professionals to rethink how they design, deliver, and communicate benefits.

This article outlines the path, the UK employee benefits landscape report provides the detail, and our expert consultants can provide the advice and support.

For over four decades, Broadstone has helped organisations navigate employee benefits: auditing the present, designing for resilience, and communicating with clarity so benefits are used, not just offered.