It is fair to say that the economic environment over the past few years has been turbulent with the biggest pandemic in 100 years, and conflict in Ukraine fuelling inflation and high interest rates. More recently, there are signs of optimism as inflation has cooled, and interest rates have stabilised, with market expectations for rate cuts in the second half of the year.

For much of this period credit performance has remained largely under control, helped by lenders tightening at the front end, Covid support and savings build up, coupled with solid wage growth. However in recent times, as the cost-of-living crisis has persisted there have been strong indicators that credit performance has worsened. Across several portfolios we have analysed recently, we have seen significant credit risk deterioration, observed across the risk spectrum and for different asset types.

Data Trends

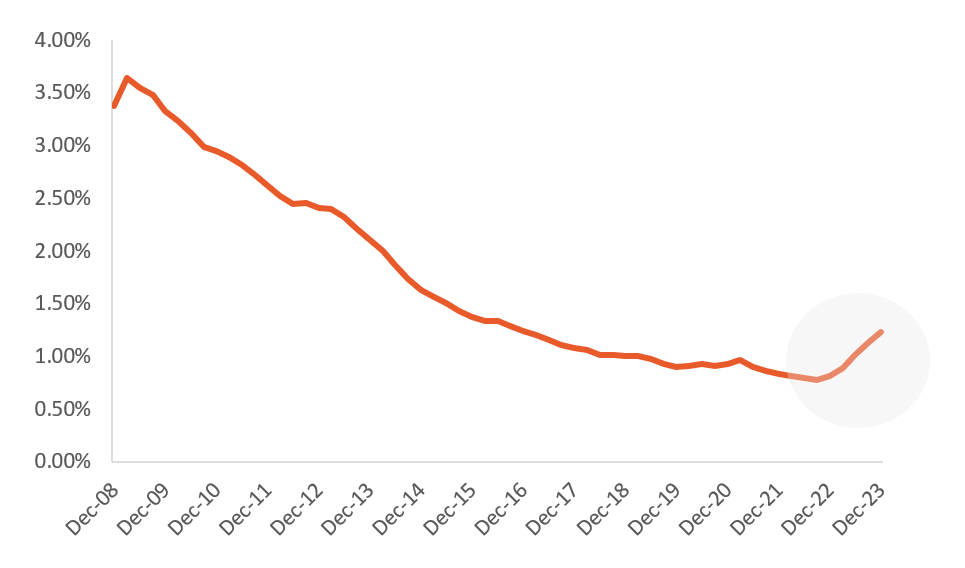

On the mortgage side, credit deterioration is evidenced by the latest mortgage arrears figures released by the Bank of England (BoE), which demonstrate that arrears rates are 1.5x higher for the end of 2023 compared to the end of 2022. The stress has been much greater on Buy to Let (BTL) portfolios, where arrears have more than doubled over the past year. This is likely driven by mortgage costs increasing faster than rent costs as landlords are unable to pass on the full cost increase to tenants. In turn, this appears to be causing a sharp decline in BTL lending, which is now less attractive to potential landlords.

UK Residential Mortgage Arrears Rates (Source: BoE)

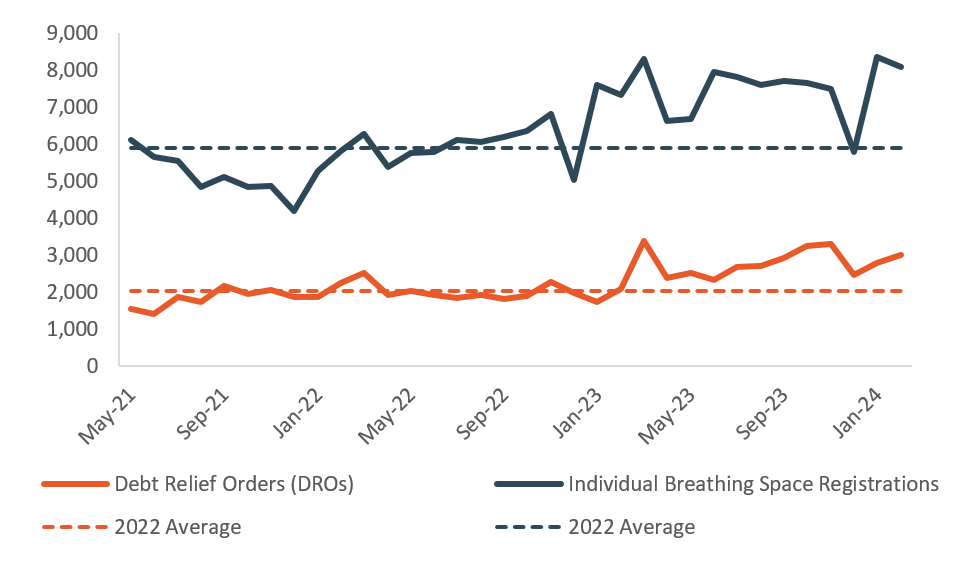

In the unsecured loan market there is less publicly available arrears data, other than unsecured write-off rates which broadly remain stable, but these do lag arrears. There are some other softer signals of deterioration; for example the debt charity StepChange has reported a 10% year-on-year increase in new clients, while new Breathing Space and Debt Relief Orders (DRO) have trended upwards. All of these markers point to an increase in the number of customers in financial difficulty.

Individual Insolvency Volumes in England & Wales (Source: The Insolvency Service)

Outlook

We would expect to see some further deterioration as effective mortgage rates have yet to peak due to the stock of fixed rate mortgages – the BoE project that 1m mortgage accounts will experience a £300+ increase in their monthly payment in 2024 with a further 800k in 2026. Borrowers will need to come to terms with higher rates than what many have become used to in recent years. This coupled with persistent cost of living pressures and signs of slowing wage growth could cause further stress to consumers.

More positively, arrears rates remain low in comparison to their historic levels, and nowhere near the peaks seen in the aftermath of the 2007/2008 financial crisis. In addition there are still good levels of credit demand and supply in the market. It is as important as ever for lenders to closely monitor their portfolios and react to any warning markers accordingly to maintain profitable lending.

The actions we have seen lenders take to maintain performance include some of the following:

- Switching off segments of lending that are now unprofitable, where there is no desire to increase price to account for the higher losses

- Rebuilding or recalibrating front end models to adjust for the latest performance data, and adding overlays to account for any further deterioration

- Introducing additional third-party data sources to support credit risk and fraud assessment at the front end as well as collections

- Investing in portfolio modelling and pricing models to enhance understanding of value; the optimum price and the long-term impact of the price changes.

If you are interested in finding out how Broadstone’s Credit Risk team could help your business, please get in touch.