By Adam Bexson, Senior Consultant

Salary sacrifice – often called salary exchange – isn’t new but it’s back in the spotlight following the November 2025 Budget.

For employers, salary sacrifice is a strategic opportunity to reduce costs and boost employee financial wellbeing – especially if you act now.

From April 2029, employer National Insurance (NI) savings will only apply to the first £2,000 of salary-sacrificed pension contributions each year. The good news? Salary sacrifice still offers meaningful value – and now’s the time to make the most of the savings.

To help you understand what the new rules could mean for your organisation and your benefits strategy, we offer a free impact assessment. We’ll estimate the financial impact on employer NI savings and set out practical strategies to help you plan with confidence.

Request a free impact assessment

What is salary sacrifice and why should you care?

Salary sacrifice is an agreement where an employee gives up part of their gross salary, and you (the employer) pay the equivalent amount into their pensions instead.

Why does this matter? Because the sacrificed amount is exempt from Income Tax and NI, creating savings for both employee and employer.

Here’s a simple example.

An employee earning £38,000 who sacrifices 5% of their pay could save around £150 in National Insurance each year. And the employer saves nearly £300.

Scale that across your workforce and the savings are compelling. These savings could be reinvested into benefits, shared with your employees or used to offset other costs.

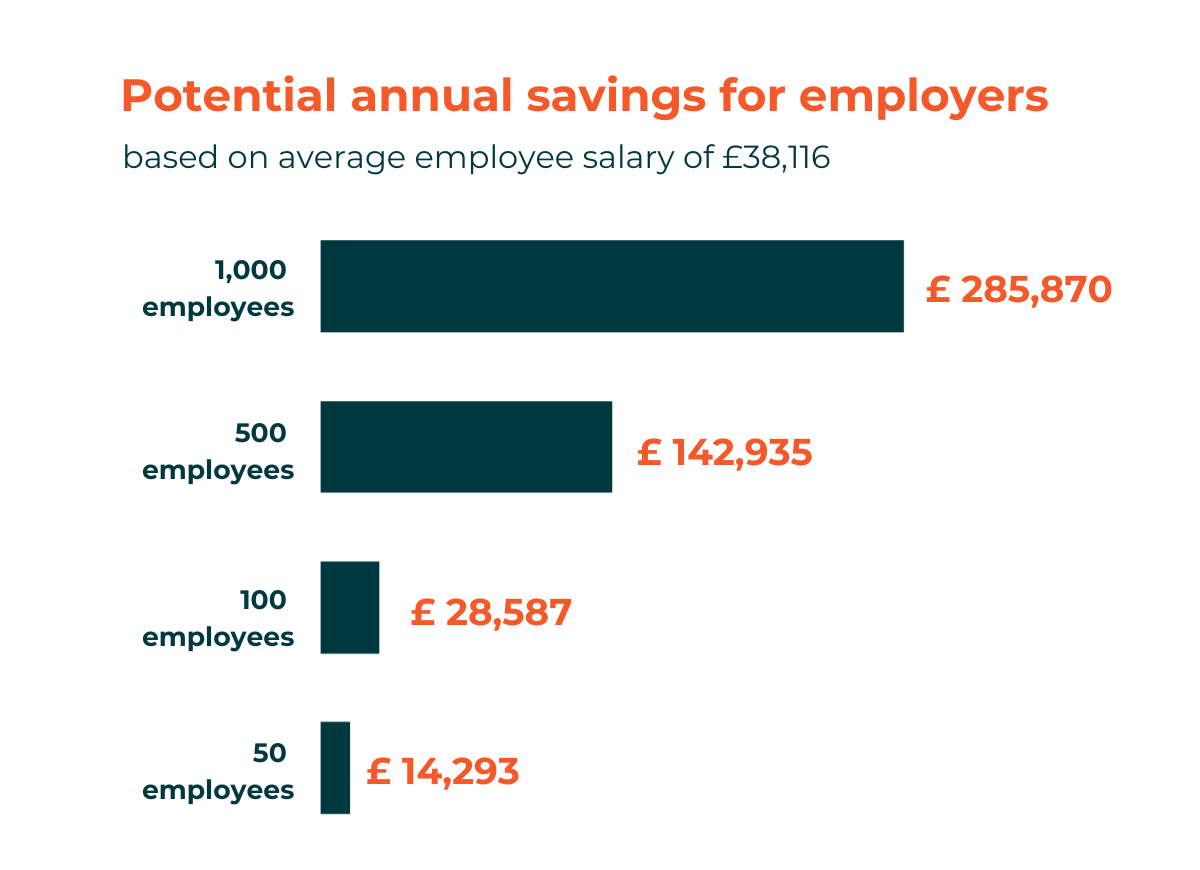

50 employees = £14,293

100 employees = £28,587

500 employees = £142,935

1,000 employees = £285,870

This illustration is based on employees having an average salary of £38,116 and contributing 5% of their pay to their pension.

Budget changes: what’s coming in 2029?

From April 2029, NI savings will only apply to the first £2,000 of sacrificed salary per year. Contributions above that still attract Income Tax savings. So while salary sacrifice remains valuable, the window for maximising NI savings is now.

For employers, this means two things:

- Act early to encourage higher contributions before the cap takes effect.

- Communicate clearly so employees understand the benefits and timing.

A smart move before the rules change

- Immediate cost savings: NI reductions add up fast, especially for larger workforces.

- Employee wellbeing: More take-home pay and a better pension helps support employee financial wellbeing.

- Tax efficiency for higher earners: Helps avoid thresholds for Child Benefit and personal allowance loss.

- Less paperwork hassle: Higher-rate tax relief is automatic. There’s no need for those employees to complete a tax return. This matters because many higher-rate taxpayers miss out on the tax relief they’re entitled to – an estimated £1.3bn went unclaimed between 2016/17 and 2020/21.

While the cost saving benefits of salary sacrifice are enticing, there are a few things you need to consider.

Compliance checks: Ensure salary sacrifice doesn’t push pay below National Minimum wage.

Language matters: Consider using the term salary exchange, which is more positive and may resonate better with your employees.

Plan ahead for 2029: Encourage higher contributions (if affordable) before 2029 to maximise savings for you and your employees.

Salary sacrifice still pays so act now

Salary sacrifice remains one of the most effective ways to deliver savings for your business and your people. With changes on the horizon in 2029, now is the time to act to take advantage of the benefits.

Our consultants can help you assess the opportunity and make salary sacrifice work for your organisation.

Understand the financial impact before the changes hit

Find out how the upcoming NI changes to salary sacrifice could affect your organisation’s costs.