Managing General Agents (MGAs) are operating in a market that is evolving rapidly. Regulatory expectations are rising, competition is intensifying, and carriers are demanding greater transparency. In this environment, Management Information (MI) is no longer a reporting afterthought – it is a business-critical asset.

Done well, MI equips MGAs to monitor objectives, evidence governance, and make informed strategic decisions. Done poorly, it creates cost, inefficiency, and risk.

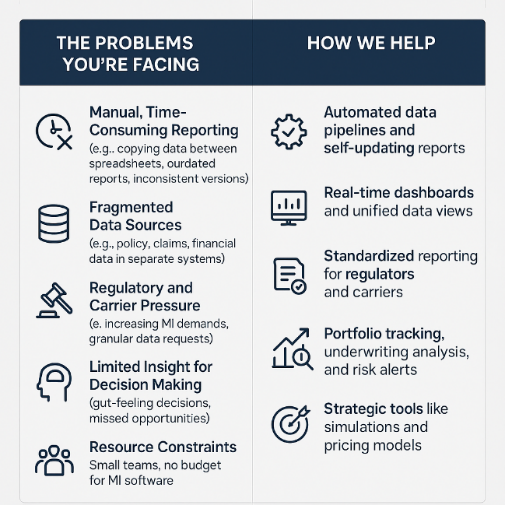

The challenges for MGAs

For many MGAs, MI is still a manual and time-consuming process. Fragmented systems and increasing reporting demands mean that valuable insight is often lost in the process of pulling data together.

Common challenges include:

- Extracting consistent insight from multiple data sources

- Balancing proportionality with regulatory and carrier expectations

- Automating reporting without the cost of large-scale IT investment

- Embedding MI into decision-making, not just compliance

- Turning Data into Strategic Insight

Broadstone’s Insurance, Regulatory & Risk (IRR) division helps MGAs transform MI from a burden into a driver of growth, governance, and profitability.

We work with MGAs to:

- Produce timely, accurate reports with minimal manual intervention

- Develop MI frameworks for strategic planning and performance monitoring

- Design dashboards to track underwriting, risk, and key portfolio metrics

- Automate data pipelines for greater efficiency and consistency

- Run portfolio simulations to inform onboarding and carrier negotiations

- Perform internal reserve reviews tailored to the MGA’s portfolio

- Build underwriting and pricing models specific to individual lines of business

- Meet carrier and regulatory reporting requirements with confidence

By leveraging modern, cost-effective tools such as Python, we create tailored solutions without the expense of commercial software – ensuring proportionality for each MGA’s size, portfolio, and budget.

Ensuring quality and excellence

Excellence in MI requires more than automation. It requires assurance.

Broadstone applies professional standards equivalent to the IFoA’s Quality Assurance Scheme (QAS), supported by secure development and ISO27001 policies. This gives MGAs confidence that their MI is not only accurate and timely, but also consistent, reliable, and defensible.

How we can help

What sets Broadstone apart is our ability to combine deep insurance knowledge with data and actuarial expertise. We don’t just build dashboards – we help MGAs interpret results, evidence value to carriers and regulators, and embed MI into day-to-day decision-making.

By bridging the gap between data execution and strategic oversight, we ensure MI delivers what MGAs really need: confidence through capability.

Next steps

For MGAs, high-quality MI is no longer “nice to have.” It is central to profitable underwriting, strong carrier relationships, and regulatory confidence.

Broadstone’s IRR team partners with MGAs to turn data into decisions, and MI into a genuine source of competitive advantage.

If you are ready to unlock more from your MI, we are here to help.