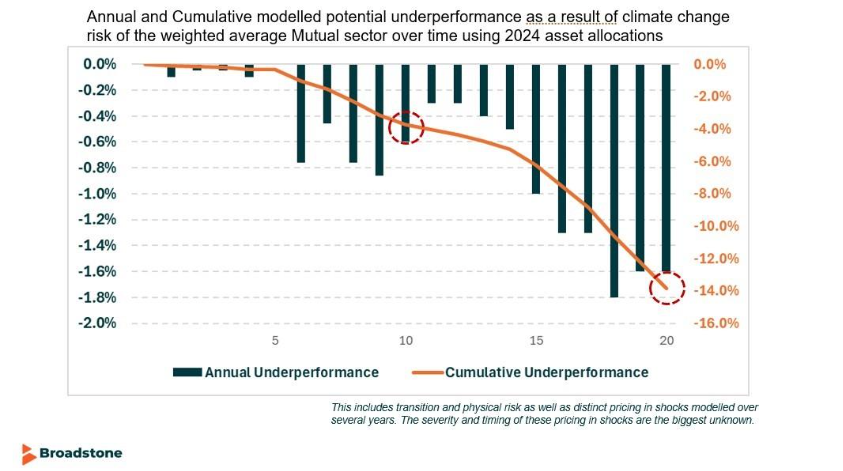

We assessed climate change risk for mutual insurers’ current asset portfolios. On average, the cumulative underperformance – meaning the extent to which investment returns were lower than expected due to climate-related risks – was 4% and 14% over 10 and 20 years, respectively.

Following Broadstone’s report on 2024 Solvency and Financial Condition Reports, we undertook a high-level assessment of climate change risk across the reported group of mutual insurers using their published asset mix and suitable assumptions. For this exercise, ahead of the Association of Financial Mutual’s 2025 Conference, we applied a “best estimate” scenario based on 3°C warming by 2100.

We compared our standard capital market assumptions with climate change risk adjustments over different terms. On average, the cumulative underperformance was 4% and 14% over 10 and 20 years, respectively.

There was significant variability across the group, with 20-year underperformance ranging from almost nil to around 30%, reflecting differences in asset mix and susceptibility to climate change risk by asset category.

David Gray, Senior Consultant and Actuary at Broadstone, commented that working with individual insurers with access to much more detailed asset portfolios would allow a tailored assessment, inform senior management, and enable action to manage investment performance in the face of climate-related risks over various time horizons.

Broadstone has partnered with Ortec Finance, the industry leaders in risk management solutions for insurers and pension funds, to access their climate scenarios. This enables us to deliver bespoke modelling solutions across climate scenarios, with specific narratives and associated climate warming temperatures, in excess of pre-industrial temperature benchmarks. These range from Delayed Net-Zero of 1.9ºC to High Warming of 3.7ºC, with the Best Estimate scenario, referenced above, using a 3ºC rise.

Deon Dreyer, Investment Director and Head of ESG Advisory, commented, “These scenarios allow analysis across asset classes, sectors, regions, through time, enabling detailed assessment of the climate change risks which are present and emerge in underlying portfolios. We also have the ability to determine which factors are the drivers of this climate change risk, namely physical risk, acute (extreme and event driven) or chronic (gradual and ongoing), transition risk, or pricing in shocks.

Whilst these robust climate scenarios allow us more insight into the composition and severity of climate change, scenario analysis does have its limitations and should not be used in isolation, but rather as one of the tools helping inform decisions and adding to a robust risk management framework.”

Challenges in Current Risk Frameworks

This analysis highlights the importance of quantifying financial exposures to climate change risk – an area where the regulator perceives many insurers still fall short. Supervisory feedback asserts that while most have begun integrating climate-related risks into their risk appetite frameworks, the metrics used often lack the granularity needed for effective monitoring and capital allocation.

PRA’s Consultation Paper CP10/25

The PRA’s consultation paper CP10/25 directly addresses these challenges. It builds on the regulator’s previous guidance (SS3/19) and proposes a more structured approach to climate-related risk management. The updated supervisory statement, once published, will replace SS3/19 and consolidate feedback, guidance, and international standards.

The PRA continues to expect firms to adopt a proportionate risk management response based on the materiality of climate-related risks to their regulated activities. To support this, the updated supervisory statement outlines a two-step process:

1. Identify material climate-related risks and assess their impact on business model resilience over relevant time horizons and under appropriate climate scenarios. These should then be reviewed and agreed by the board.

2. Adopt a proportionate response aligned with the firm’s assessed climate change risk profile.

Implementation Timeline and Industry Commentary

Importantly, the PRA proposes that firms conduct an internal review following publication of the final statement, identifying gaps and planning remedial actions. Supervisors will not request evidence of these assessments or plans until six months after publication. This grace period may coincide with year-end valuations, which typically require significant resources.

David Gray noted this timing challenge but welcomed the updated statement as a useful evolution. “It develops SS3/19, consolidates feedback and guidance, and incorporates improved understanding of climate change risks and international standards,” he said. He also emphasised the need for collaboration, adding that the PRA’s plan to engage actively with industry groups is a positive step toward developing best practice.

This sentiment was echoed in the AFM’s consultation response, which offered constructive criticism aligned with the mutual sector’s collaborative ethos.

Broader Implications for ORSA

Broadstone works with clients to inform Own Risk and Solvency Assessments (ORSAs), and they are a key tool to manage all risks. The evolution of the balance sheet depends on stressed payments to policyholders and the availability of assets. We recognise that climate change – via, by way of examples, heat stress, vector-borne diseases, and air pollution – can affect sickness incidence, recovery, and ultimately mortality. These impacts, along with policyholder behaviour (e.g. lapses), must be considered alongside broader economic factors to determine liability amounts and timings. An important development is a consistent projection of asset proceeds at a more detailed level.