Written by Rob Hillock, Jeremy Brown, Damon Hopkins, Brett Hill, and David Brooks

Updated 24th November 2025 (originally posted 6th November 2025)

The UK Autumn Budget 2025 is poised to be a pivotal moment for the country’s fiscal policy, with potentially significant implications for individuals and businesses.

Against a backdrop of economic uncertainty, shifting political priorities, and evolving public expectations, speculation is mounting regarding potential changes the Chancellor might announce to taxation, pensions, and public spending.

The big three: Income tax, National Insurance, and VAT

Within their 2024 Election Manifesto, Labour pledged not to raise these three key taxes. When questioned in July by the opposition leader as to whether the pledge would stand, the Prime Minister gave an emphatically positive one-word, three-lettered answer.

However, when asked the same question again at the end of October 2025, the answer was less emphatic. Speculation has since raged that taxes on ‘working people’ will indeed rise, especially after the Chancellor’s speech on 4 November where tax rises are clearly on the cards.

Our Autumn 2025 budget predictions

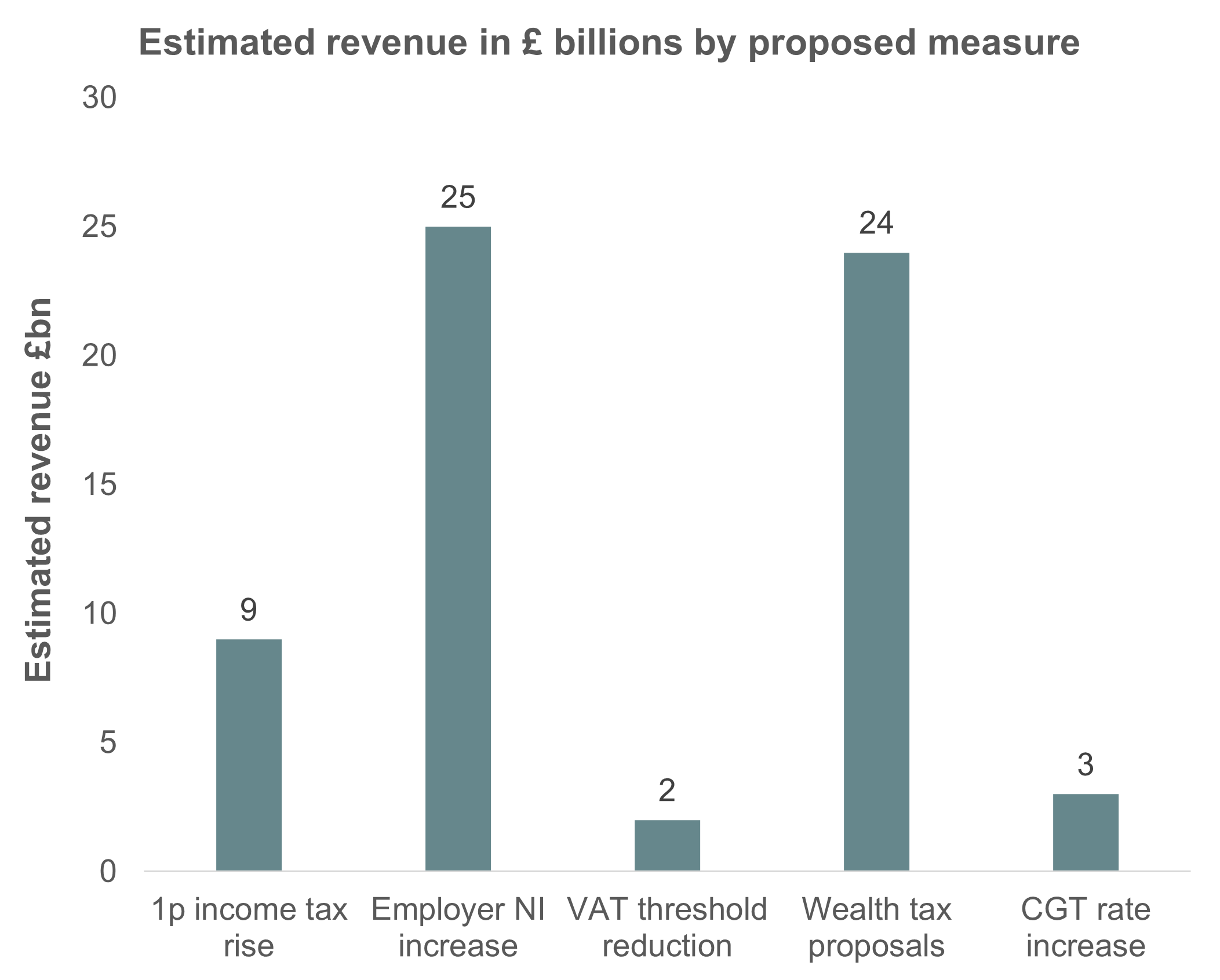

Here are our views on the loudest rumours, the proposed outcomes and the likelihood of making it to the top of the Chancellor’s hit list, which we aim to keep updated as new rumours materialise and kite flying ramps up.

We scored each rumour using a scale where 0 is no chance and 5 is guaranteed to happen.

Rumour – A possible 1 or 2p rise in income tax

Possible outcome: Three months ago, it seemed almost impossible. It then seemed to be the most likely pledge to be broken, but now appears to have been ruled out. A 1p rise to the basic rate would raise around £7bn in the first year, but the political risk of breaking the manifesto pledge seems too great.

If Income Tax is indeed increased across all bands, National Insurance could be reduced at the same rate, protecting ‘working people’ but would raise revenue via other income sources such as rental income.

Alternatively, Income Tax rates could simply be increased at the higher and additional rates, with the possibility of reducing the earnings thresholds of the higher bands.

Moving the higher rate from 40% to 41% would raise a further £2bn.

Possibility: 1 out of 5

Rumour – Imposing National Insurance on partners and landlords

Possible outcome: Limited liability partnerships (LLPs) to be brought into the scope of National Insurance, affecting 200,000 lawyers, accountants and other which could raise up to £1.9bn.

Possibility: 3.5 out of 5

Separately, the Resolution Foundation has recommended that landlords should be made to pay National Insurance at 20% per cent and an additional rate of 8% for property income over £50,270 a year, raising £3bn a year.

Possibility: 2.5 out of 5

Rumour – VAT threshold changes

Possible outcome: Lowering the threshold for VAT registration and/or reclassifying certain goods or services wouldn’t strictly be changing the VAT rate, but many more small businesses would be pulled into the VAT net.

Would Labour risk breaking the manifesto with rises in two of the big three? One out of three now seems more likely.

Possibility: 4 out of 5

Rumour – Inheritance Tax

Possible outcome: Hated by many, paid by few.

Changes were made in last year’s budget with pensions due to form part of your estate from 2027, but will they go further? Many of the exemptions available to mitigate inheritance tax have been left alone for over 40 years, so you could argue that a review is long overdue.

Any adjustments to planning mechanisms such as the ‘7-year rule’ – where gifts can be potentially out of the donor’s estate after a period of seven years – may bring even more estates into paying tax.

Possibility: 4 out of 5

Budget – Beyond the Headlines

Join us on Thu, 27 Nov | 14:00–15:00 GMT | Online

A fast-paced, expert-led session unpacking key pension and employee benefit changes from the Autumn Budget. From tax relief reforms to employer contributions — get the insights that matter.

Rumour – Wealth Tax

Possible outcome: As the cost of living remains a key economic issue in the UK, any increases in income tax would further squeeze already tight budgets.

A 2% levy on assets over £10m, council tax reform for high value homes, replacement of stamp duty with a new high value property tax, further cuts to capital gains tax (CGT) allowances and equalisation with income tax band levels, even taxing the capital gain on main residential properties, are all ideas that have been floated.

Given the popular view (at least within the current Government) that any increase should fall on those with the broadest shoulders, at least one of these seem likely.

Possibility: 4.5 out of 5

Rumour – Pension reform

Possible outcome: A reduction or complete removal of the tax-free cash would be a hugely controversial move. And one which would likely cause havoc for those who have planned their future on the ability of being able to draw 25% of their defined contribution pension down as a tax-free lump sum.

The level has already been capped for the majority of savers at a little over £250,000, so will the Government cut harder and deeper. Whilst a relatively easy target, this is one that would likely be impossible to implement overnight.

Any change to the tax free cash now appears to have been ruled out.

Possibility: 1 out of 5

A flat rate of tax relief has often been suggested but, again, very difficult to implement and likely to be deeply unpopular amongst those in the public sector.

Possibility: 1 out of 5

Rumour – Reduce salary sacrifice for pensions

Possible outcome: Reduce salary sacrifice for pensions by limiting the maximum amount that can be contributed tax-free. It would mean employees and employers pay more National Insurance (NI) on pension contributions.

While completely abolishing salary sacrifice might be considered, capping the relief is seen as the more likely option to avoid penalising average workers.

How the change would work:

- Targeting salary sacrifice: The reform would focus on schemes where employees give up a portion of their salary for a pension contribution, saving on income tax and NI.

- Limiting tax relief: A cap is likely to be placed on the amount of pension contributions that can be made through salary sacrifice without incurring NI.

Possibility: 4 out of 5

Rumour – Insurance Premium Tax increases

Possible outcome: An increase in Insurance Premium Tax (IPT), from the current level of 12% on General Insurance products such as home insurance, car insurance and Private Medical Insurance (PMI).

IPT has been the gift that keeps on giving for the Government in recent years, as the post-Covid inflationary spike pushed up premium costs across the general insurance sector, which in turn pushed up IPT receipts.

IPT became a popular lever for cash-strapped Chancellors in the wake of the 2009 financial crisis. Between 2011 and 2017 rates were steadily increased from 6% to 9.5%, then to 10%, and finally 12%; now IPT raises almost £9 billion a year.

A further increase maybe tempting as an alternative to raising taxes that are subject to manifesto commitments. Any increases would fuel inflation at a time when cost of living pressures persists for many, and when inflation remains well above the Bank of England’s target rate of 2%.

Increasing IPT on PMI would also be counter-productive, as it would push people back into an NHS still grappling with long waiting lists and ongoing industrial disputes.

Possibility: 3 out of 5

Final thoughts

While the rumours and counter-rumours surrounding the UK Autumn Budget 2025 may be unsettling, uncertainty is nothing new when it comes to personal financial planning or running a successful business. Economic and political shifts have always posed challenges — but the fundamentals remain unchanged.

Ultimately, we won’t know what is contained within the Budget until Wednesday 26th November. And, even then, there’ll be the inevitable devil in the detail.

At Broadstone, we are here to provide you with the support and advice needed in uncertain times.