Executive Summary

Despite an increasing financial complexity in modern life, financial education remains inconsistently available to secondary schools in the UK. While some progress has been made, particularly through the inclusion of financial topics in Personal, Social, Health and Economic (PSHE) education, the current curriculum lacks the depth and consistency needed to equip young people with a minimum standard of financial literacy.

Introduction

The UK faces a growing financial literacy crisis and according to a 2023 report by the Centre for Financial Capability, only 38% of UK children aged between 7 and 17 receive meaningful financial education at school (Centre for Financial Capability, 2023).

Young people are entering adulthood without the knowledge or skills to manage money effectively, which may lead to poor financial decisions, increased debt, and long-term economic vulnerability. With the rise of digital banking, student loans, and complex financial products, access to comprehensive financial education has never been more necessary.

Current Curriculum Coverage

Financial education is currently included in the national curriculum for maintained secondary schools in England, primarily through:

- Mathematics: covering basic financial numeracy (e.g. interest rates, percentages).

- PSHE Education: offering optional modules on budgeting, saving, and financial decision-making.

However, academies and free schools are not required to follow the national curriculum, leading to inconsistent delivery. A 2024 Education Committee report found that while financial education is present in theory, in practice it is often under-prioritised due to time constraints, lack of teacher training, and insufficient resources. As a result of this, only 17% of teachers feel confident delivering financial education (Young Enterprise & Young Money, n.d.).

Where do students get most of their financial understanding from?

The Complexity of Financial Planning

Modern financial planning involves a range of skills and knowledge areas, including:

- Budgeting: Understanding income vs. expenses, needs vs. wants.

- Debt Management: Navigating credit cards, loans, and interest rates.

- Saving and Investing: Building emergency funds, understanding compound interest, and long-term planning.

- Taxation: Understanding payslips, income tax, National Insurance, and student loan repayments.

- Digital Finance: Using online banking, avoiding scams, and managing digital wallets.

These topics are rarely covered in sufficient depth, leaving students unprepared for real-world financial responsibilities.

Consequences of Financial Illiteracy

The lack of financial education has tangible consequences:

- Rising Youth Debt: Many young people rely on credit without understanding repayment terms.

- Poor Saving Habits: A significant proportion of young adults have little or no savings.

- Limited Understanding of Tax and Employment Rights: Many school leavers are unaware of how taxation works or what deductions appear on their payslips.

- Vulnerability to Scams: Digital natives are increasingly targeted by online financial fraud.

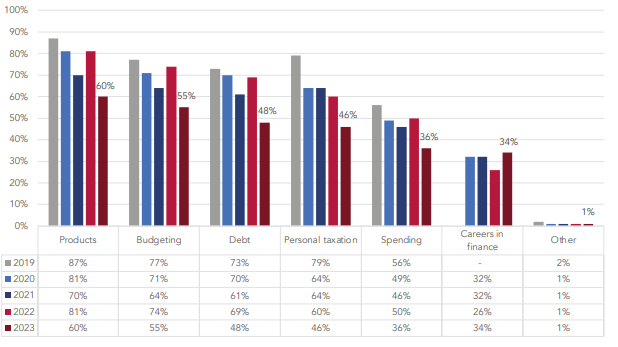

What would you like to learn more about?

Recommendations

There is little we can do to control the current economic landscape, but we do have the ability to equip young adults to make the most of their financial situation and opportunities.

Students who receive financial education are twice as likely to save regularly and less likely to fall into debt traps later in life(Money and Pensions Service, 2024).

At Broadstone we want to provide support for students and can offer a range of services that we believe will build financial confidence and wellbeing.

The sessions aim to support students through periods of financial turbulence, inflation and cost of living crises. We’ll help them set goals for the year ahead, minimise expenditure, make quick wins and create good spending habits today whilst looking ahead at the future by considering the vehicles for saving and investing. There will also be the opportunity to ask questions to a knowledgeable financial services professional.

Conclusion

Financial education is not a luxury, it is a necessity. As the UK government undertakes a Curriculum and Assessment Review in 2025, there is a critical opportunity to embed financial literacy as a core component of secondary education. Doing so will empower the next generation to make informed, confident financial decisions and contribute to a more financially resilient society.

References

Centre for Financial Capability, 2023 https://www.fincap.org.uk/en/articles/levels-uk

Young Persons’ Money Index 2023/24 YPMI-report-2023-24.pdf

Young Enterprise & Young Money https://www.young-enterprise.org.uk/home/impact-policy/research-evaluation/research/impact-of-financial-education/

Money and Pensions Service, 2024 https://www.fincap.org.uk/en/articles/levels-uk