Update On Financial Markets Affecting DB Pension Schemes

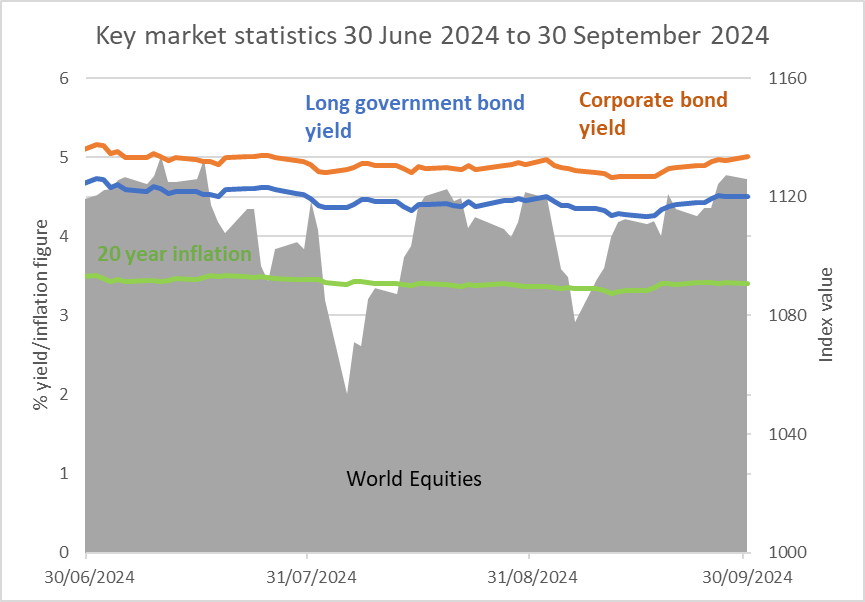

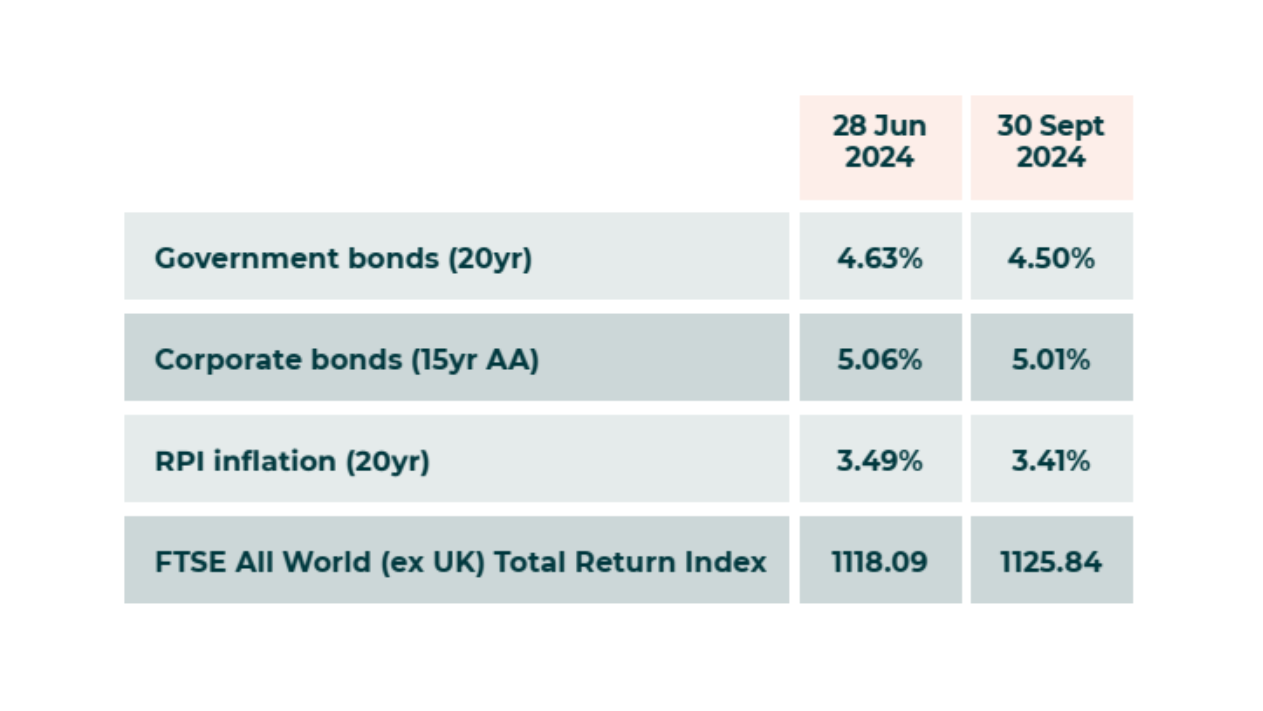

There has been another small decrease in corporate and government bond yields over the quarter. Long-term inflation expectations have fallen slightly. Equity markets have also increased slightly over the period. As a result, the majority of schemes are likely to have seen little change in their funding positions over the quarter.

Government and corporate bonds yields remain high, and the funding positions of many Defined Benefit (DB) schemes are still improved compared to historical positions. Sponsors and trustees should be pro-actively discussing investment strategy and long-term plans to ensure that any funding gains are protected. Insurance companies remain busy, preventing some schemes from being able to proceed with buy-out in the short term so it is still important to take actions to protect funding positions in the meantime.

Preparing for Upcoming Actuarial Valuations in a Year of Significant Change

The most significant change in DB scheme funding for many years has now come into force: new funding regulations accompanied by the Pensions Regulator’s new Funding Code, applicable to actuarial valuations with an effective date from 22 September 2024.

Employers with DB schemes should start planning for their next valuation, which is likely to be quite different from their last one. Many valuations, particularly for smaller schemes, will require a much greater focus on the employer’s covenant, with specific metrics to determine and more analysis and questioning of cashflows (including their reliability and how they’re being used). It would be prudent for employers to start thinking about the presentation of this analysis now to put themselves in the best position.

Also, although most schemes already have broad long-term strategies in place, the Code mandates these with a requirement for specific documented plans, encouraging prudent funding and/or over a shorter timescale. This will force debate and firmer strategic commitments between trustees and sponsors, as well as almost inevitably result in higher contributions for many employers and a heightened risk of overfunding and trapped surpluses.

A final key change is that schemes will be able to follow a defined “Fast Track” valuation approach, passing specific requirements to minimise regulatory scrutiny. For the other schemes following a “Bespoke” route, their funding plans will be reviewed in more detail, with management of investment risk and covenant leakage (such as dividend payments, director remuneration and intra-group loans) likely areas of focus. Meeting the Fast Track requirements will be more challenging for employers with poorly funded schemes, as they may struggle to fund deficit recovery periods of no more than 6 years (or 3 years if the scheme is assessed as mature).

Broadstone can help employers with pragmatic, expert advice on navigating the new funding regime; please consult your usual Broadstone contact or Stuart Bradbury at stuart.bradbury@broadstone.co.uk

The Importance of Prevention for Employee Health and Wellbeing

Most businesses are dealing with skills shortages of some form or another and this alongside increasing NHS waiting lists and private medical insurance costs has led to a growing client focus on preventative and proactive health and wellbeing services. Broadstone recognises that an effective employee wellbeing plan can assist with employee retention and productivity, and positively influence claims costs and associated premium increases on company-funded health and protection plans.

While medical advancements have made it possible to treat many diseases and conditions, the old adage “prevention is better than cure” still holds true. By investing in preventive care, companies can identify health issues early, reducing the need for expensive treatments and medical interventions later on which impact private medical insurance costs.

Implementing Preventive Measures

Companies should start by assessing the specific health needs of their workforce through health risk assessments and employee surveys. Tailored programmes and initiatives can then be developed and deployed based on the findings. Some examples are noted below – the options are wide ranging to suit every budget and often, some services may already be available as part of existing insurances:

- Health screenings and vaccinations

- Mental health support:

- Financial wellbeing support

- Ergonomic workstations

- Wellness programmes

- Flexible work arrangements

- Healthy eating options

- Smoking cessation programmes

How Broadstone Can Help

Expertise and Knowledge: Every workplace is unique, and there is no one-size-fits-all approach. Broadstone’s expert consulting team can help employers implement effective preventive practices that are relevant to their specific needs and develop tailored solutions that address these.

Employee Engagement: Broadstone can provide insights on how to engage employees in health and wellbeing initiatives. This includes creating programmes that are appealing and accessible to all employees, increasing participation and effectiveness.

Ongoing Support and Evaluation: Broadstone offer ongoing support to ensure that preventive practices are effectively implemented and continuously improved. We also help evaluate the success of these initiatives and make necessary adjustments. By leveraging the expertise of Broadstone, employers can create a healthier, more productive workplace.

The Power of Prevention – in person event in London on 28th November.

If you would like to know more join us as we learn from leading Industry experts as they share their experience and insights about the latest developments in workplace health and employee benefits, details here.