Update on financial markets affecting DB pension schemes

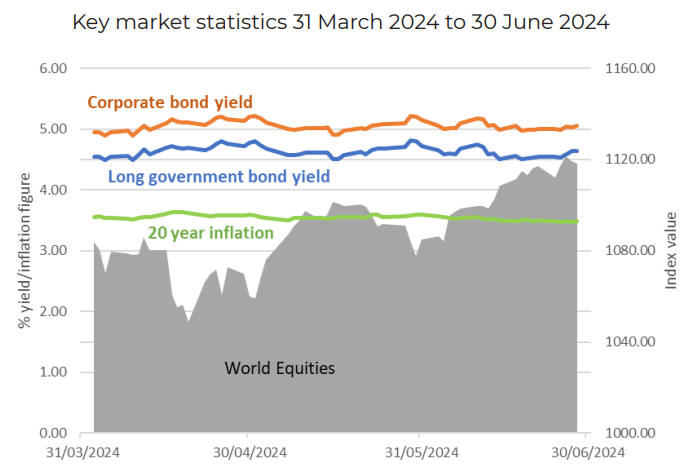

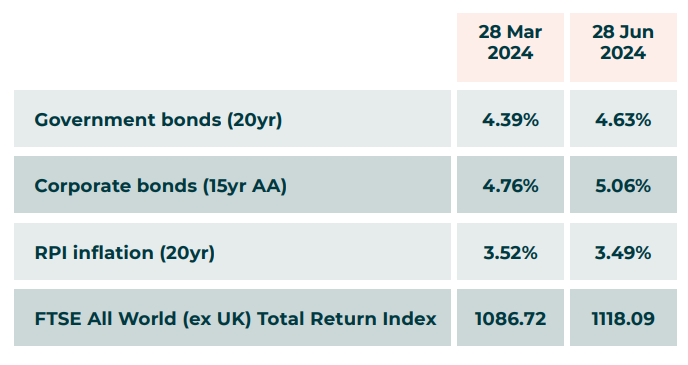

There has been another small increase in corporate and government bond yields over the quarter. Long-term inflation expectations have fallen slightly. Equity markets have also increased over the period. As a result, the majority of schemes are likely to have seen a slight improvement in their funding positions over the quarter.

Government and corporate bonds yields remain high, and the funding positions of many Defined Benefit (DB) schemes are still improved compared to historic positions. Sponsors and trustees should be pro-actively discussing investment strategy and long-term plans to ensure that any funding gains are protected. Insurance companies remain busy, preventing some schemes from being able to proceed

with buy-out in the short term so it is still important to take actions to protect funding positions in the meantime.

End-game planning for your DB scheme

The rises we have seen in gilt yields in recent years has led to a major shift in the landscape for DB schemes, with many schemes improving their funding positions and even building up healthy surpluses. This is leading to wider strategic discussions with scheme trustees on what the long-term plan for the scheme should be.

A common viewpoint is to secure a scheme with an insurance company as soon as possible through a “buy-out”, allowing the employer to wind-up the scheme and move it off balance sheet. This brings obvious benefits in terms of removing any future pensions risk along with the expense of operating the scheme.

However, with huge market demand for buy-outs leading to less competitive pricing and delays in transacting with insurers, some employers are looking to either buy-out later or “run-on” the scheme for the foreseeable future.

Continuing to run the scheme can help reduce the eventual cost of buy-out (with insurer pricing generally being cheaper for schemes with a higher proportion of pensioner members), supported by an investment strategy aiming to balance risk mitigation with some upside to cover scheme running costs and help build surplus to benefit either the employer or members through discretionary benefit improvements.

There is considerable discussion about potential legislative changes to improve employer access to scheme surpluses – this could support those employers looking to maintain their DB scheme for the longer-term.

The best choice for a particular employer will vary due to many factors such as the size and maturity of the scheme and the financial position and risk appetite of the employer. Balancing all these factors will help you agree the right timescale for securing your DB scheme. Broadstone can help employers with pragmatic, expert advice on navigating strategic discussions with their scheme trustees; please consult your usual Broadstone or Stuart Bradbury at stuart.bradbury@broadstone.co.uk

Lifetime Allowance – No longer relevant? Not quite!

In the 2023 Budget it was announced that the Lifetime Allowance was to be abolished with effect from April 2024. This can be generally seen as a positive development – it encourages pension savings and reduces potential tax. However, as usual with UK pensions legislation, not everything is that straightforward – although the old Lifetime Allowance has gone, it has been replaced by three new Allowances.

What are the new Allowances?

Employees and pension scheme members should be aware that there will still be some restrictions on how pension benefits are taken. These are:

- Lump Sum Allowance – limits the amount of tax-free cash taken at retirement.

- Lump Sum and Death Benefits Allowance – mainly limits what can be passed on tax-free to beneficiaries on death of the member.

- Overseas Transfer allowance – imposes a limit on the amount of transfer value that can be paid overseas without incurring a tax charge.

If not already done, explanatory literature should be updated, and retirement processes amended to reflect the new requirements.

Cash in lieu policy in place?

When the Lifetime Allowance was in place there were quite punitive tax consequences for employees if they continued to remain a member of their employer’s pension scheme for ongoing contributions.

To mitigate this problem, many employers instituted a HR policy whereby if an employee could demonstrate that they had already breached the Lifetime Allowance (or were at risk of doing so) they could receive extra pay instead. Often the cash supplement was adjusted so that the overall cost to the employer was no more than the equivalent pension contribution.

At first sight it may appear that this policy is no longer needed, or can be amended, but there are some points to think about:

- Eligibility – if the policy is retained for some employees, how is this cohort of employees defined?

- Communication – when a policy is decided, communicate accordingly and consider whether to offer guidance/advice.

- Auto-enrolment – at the moment there is a ‘carve out’ in the auto-enrolment legislation for employees who are over the Lifetime Allowance. There is some uncertainty about whether employers will be on safe ground if they don’t enrol these employees in the future.

What to do?

Irrespective of any decisions on a ‘cash in lieu’ policy, it would still be a good idea to communicate the changes in the Lifetime Allowance to employees. The proposed changes are complicated, and tax may still be payable on retirement lump sums and death benefits – these complexities need to be explained so that employees are aware of what to watch out for. Broadstone can provide a range of support services to address these issues, including education sessions and 1:1 guidance or advice.