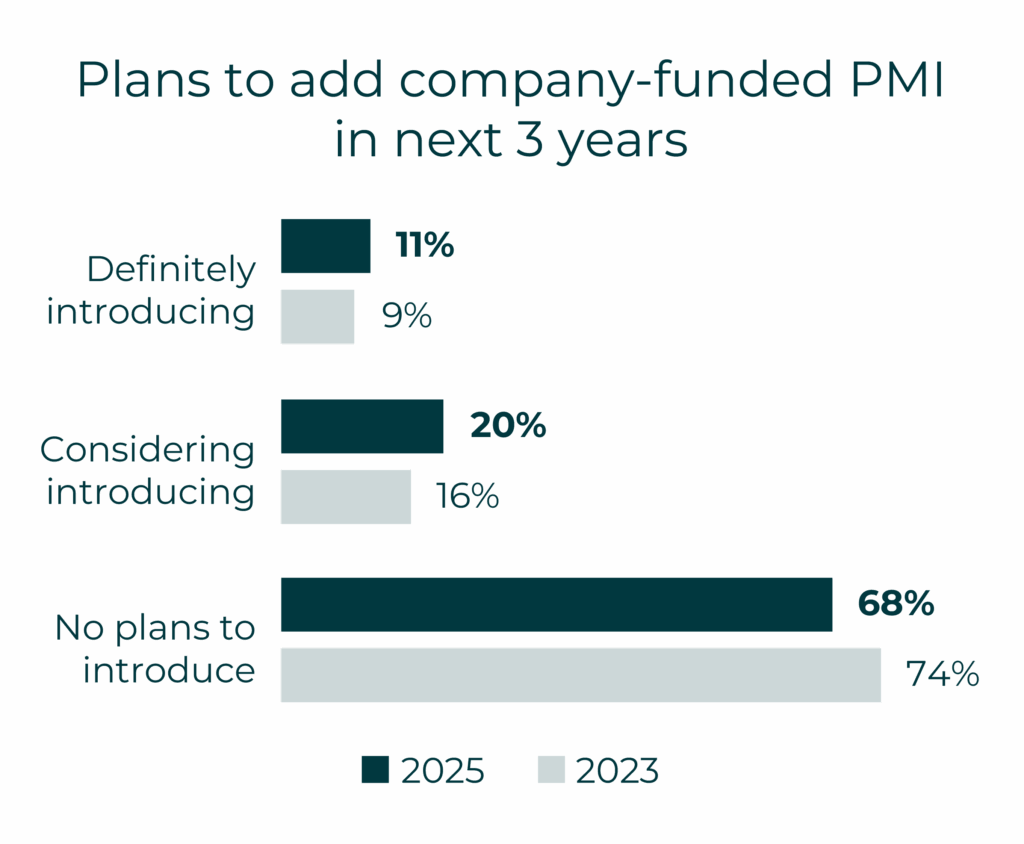

- Over one in 10 businesses that don’t currently provide PMI benefits to employees say they definitely plan to introduce PMI in next 3 years, with a further fifth actively considering it

- ABI data reveals record PMI claims and workplace insurance coverage

Healthcare benefits are becoming an increasingly integral part of benefits packages as pressure on the NHS continues to rise, according to research conducted for Broadstone’s second Employee Benefits Landscape Report.

The data taken from the Report shows that almost a third of employers who don’t already offer Private Medical Insurance (PMI) to employees are considering doing so within the next three years.

The percentage of organisations without PMI but with definite plans to introduce it rose from 9% in 2023 to 11% in 2025, with those considering it increasing from 15% to 20%. Those with no PMI plans on the horizon fell from 74% to 68%, reflecting a growing interest.

This is likely driven by organisations recognising the importance of timely healthcare access for their employees.

The growth in healthcare benefits is seen across other areas. The proportion of employers offering clinic-based screenings rose from 20% in 2023 to 25% with the proportion of businesses providing onsite day screenings increased from 7% to 10%.

Likewise, the health cash plan market expanded in 2024 which is reflected in the proportion of businesses offering this service to employees moving from 24% in 2023 to 26% in 2025. Over a quarter (26%) of employers are considering introducing a health cash plan in the next three years.

The ABI last week reported that health insurers processed a record £4 billion in individual and workplace private medical insurance claims in 2024 – up 13% compared to 2023 (£3.57bn). The total number of people covered by health insurance increased 4% from 2023 to reach 6.5 million in 2024, of which 4.8 million were covered by workplace policies.

Brett Hill, Head of Health & Protection at leading independent financial services consultancy Broadstone commented: “Healthcare benefits, such as private medical insurance (PMI) and health cash plans are becoming an essential part of benefits packages, especially in competitive industry sectors.

“The NHS remains under significant pressure which means that businesses increasingly view access to timely diagnosis and treatment as a critical factor in supporting employee wellbeing, productivity and retention.

“What’s particularly striking is the growing pipeline of employers actively planning to introduce or expand healthcare benefits over the next few years. Organisations are also taking a more preventative approach, with greater uptake of screenings and health cash plans, reflecting a broader shift towards early intervention and long-term workforce resilience.”

A link to the Report can be found here

ENDS

1ABI, Insurers process record £4bn across individual and workplace health schemes: https://www.abi.org.uk/news/news-articles/2026/1/insurers-process-record-4bn-across-individual-and-workplace-health-schemes/

Media contacts

Broadstone

Temple Bar Advisory

Alex Child-Villiers / Sam Livingstone / Alistair de Kare-Silver / Juliette Packard

[email protected] / 020 7183 1190

About the Broadstone Group

Broadstone is a leading, independent UK consultancy delivering expert advice to employers, insurers, pension scheme trustees and lenders.

For over 40 years, Broadstone has been providing its clients with a wide range of specialist services including:

- Employee Benefits Consulting

- Pensions Administration and Actuarial services

- Investment Consulting

- Insurance Consulting across life, general, and the Lloyd’s and London markets.

- Credit risk services

- Financial modelling and data analytics

- Redress calculation services

Broadstone’s team comprises nearly 1,000 expert consultants and administrators, including 90 actuaries, across 12 UK offices.