Client Wins

> Achieved 32% decrease in ‘never pays’

> Reduced the manual queue for fraud refers from 100+ cases per day to just a handful

> Successfully integrated an ML methodology within the business for the first time

> Achieved 32% decrease in ‘never pays’

> Reduced the manual queue for fraud refers from 100+ cases per day to just a handful

> Successfully integrated an ML methodology within the business for the first time

Project Length:

6 weeks

Personnel:

Director, Consultant & Analyst Team

A non-prime unsecured personal loan provider was seeing levels of first- and third-party fraud which they believed benchmarked poorly against others in the sector, leading to increased focus on fraud prevention. This fraud was manifesting in the form of ‘never paid’ and ‘one and done’ accounts (where only the first payment is made), both with significant loss attached.

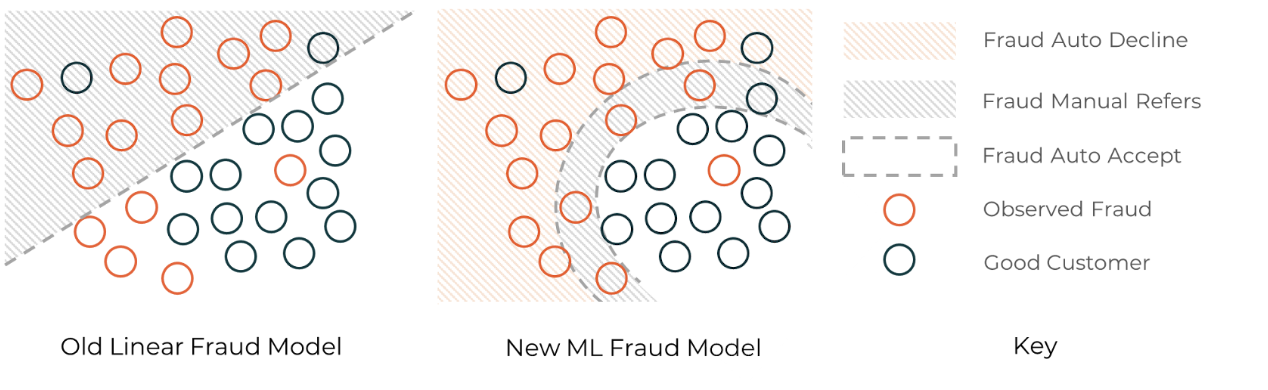

The business wanted to achieve a step change in their fraud detection capability through the deployment of a powerful machine learning (ML) based model.

The client engaged Broadstone to bring their lending and analytics expertise to bear on the problem.

Broadstone undertook careful sample and feature design to maximise the value of the client’s data and the ML modelling approach. Data engineering ensured that characteristics were derived to support the identification of both first-party (“no intent to pay”) and third-party (“impersonation/takeover”) fraud. A robust and repeatable modelling process was put in place. One of the most important considerations was that the model methodology, performance assessment, and validation metrics needed to account for the unbalanced outcome classes, both in terms of volume and severity.

The resulting model was effective in identifying fraud cases, resulting in a reduction in the never paid rate of more than 30% when implemented in the live environment. The requirement for manual fraud agents also reduced, with referrals being nuanced cases genuinely benefitting from a human assessment.

The Broadstone credit risk team have extensive credit risk modelling experience across a range of problem types. If you are interested in finding out how Broadstone could help your business, please get in touch through our contact form below.