In what was undoubtedly a momentous budget, the first by Labour for 14 years, there was initially little that stood out that would have much of an impact in what may be considered a relatively narrow area – that of pensions redress. But scratch the surface, and there are a couple of areas which are worthy of comment.

The impact on markets

The level of pensions redress is linked to the level of gilt yields. Generally, an increase in yields will lower the level of redress payable.

The immediate impact of the Budget on the level of yields has been relatively mild but this can, in all likelihood, be attributed to yields rising over the previous few weeks through speculation as to what would be in the Budget, including higher Government borrowing and potential changes in the fiscal rules.

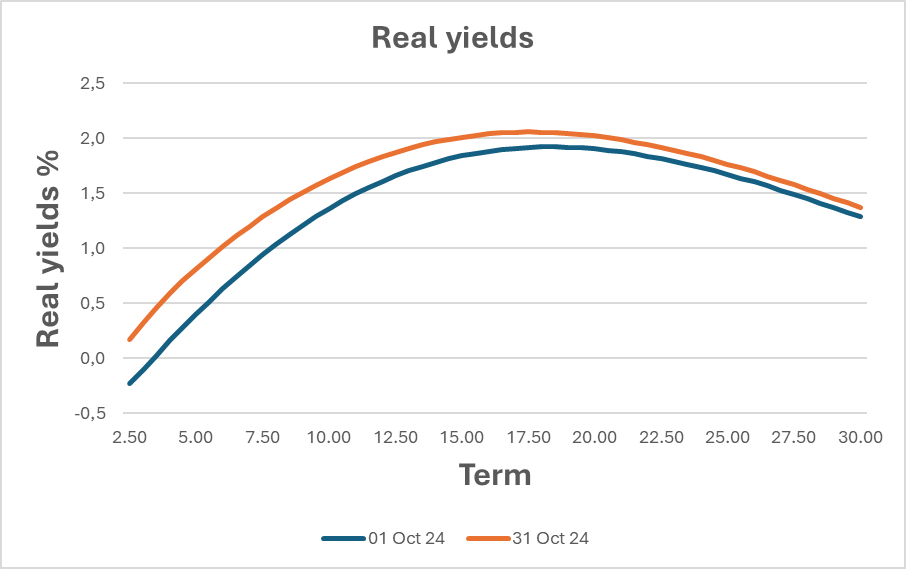

As can be seen in the chart below, the impact has been that real yields have increased by about 20bps across the curve.

Assuming that this trend is not reversed by the end of the quarter, this could mean that the assessed value of a pension will have decreased by up to 3% – 5% since the start of the quarter. This will further exacerbate the marked decrease in redress we have seen over the last two years – you can read more about this here.

Mineworkers Pension Scheme

In a quiet budget for pensions, one of the standout items was the announcement regarding the Mineworkers Pension Scheme (MPS). In terms of redress, the MPS has long been known for its complexity which makes it a harder calculation than many. This stems from how the MPS was structured following the privatisation of the coal-mining industry in 1994. In return for a guarantee provided by the Government that members’ pensions together with RPI increases to these would continue to be paid, the MPS and its members shared all funding surpluses with the Government on a 50/50 basis.

What this has meant in practice is that members have, in times of surplus, periodically been awarded a bonus – or an addition to their pension. The flipside has been that the Government has also been ‘awarded’ payments. The two previous years has seen the Government paid £142m each year from the MPS. £1.5 billion of the scheme’s assets, known as the Investment Reserve, are nominally attributed to the Government and represent its share of the surplus in 1994. There is also a Guarantor’s Fund, currently £500 million, which represent the Government’s share of surpluses that have arisen since 1994. It is the Guarantor’s Fund from which the payments of £142 million are being met.

From a redress perspective, placing a value on a pension that would have been payable from the MPS has been less than straightforward. Whilst a bonus has been added to the pension periodically, it can be, and has in the past, been reduced when the MPS has been in a funding shortfall (though this practice discontinued in 2022 for bonuses awarded before this time). It’s also not been clear whether the bonus pension would attract pension increases in the future.

So, what has changed? The Chancellor announced in her Budget that the £1.5 billion Investment Reserve will be returned to the scheme’s members. The funds will be used to enhance the members’ pensions. The Government has said that this will lead to each member seeing their pension increased by 32% (structured as a new bonus element of their pension equal to 32% of their guaranteed pension). Both this bonus, and the one given in September 2024, are subject to future claw back. The Government will also take forward a review of the current surplus sharing arrangements.

From a redress perspective, there will be questions that need answering in future cases:

- Will the additional bonus be “protected” in due course, like the earlier bonuses, or will they be non-guaranteed with the potential for future reduction should there be funding shortfalls?

- Will the guaranteed benefits continue to receive RPI increases?

- What should we expect from the review of the surplus sharing arrangements? Will a guarantee remain in place and if so, will Government still expect some quid pro quo for the continued guarantee and protection?

We will need to wait for the review and a future actuarial valuation of the Scheme to gain a better understanding of the impact. What we can say with some certainty is that pensions will be increasing this month leading to higher redress going forward for any ex-members ill-advised to transfer from the Scheme and yet to have their redress calculated.

We will continue to work to understand the impact of this change to help our clients deliver the correct level of redress.

If you need help with your redress calculation, get in touch with us.

Broadstone – redress specialists for over 30 years. For more information – visit us here.

Brian Nimmo

Roger Score